Federal budget 2023: What it means for the housing market

May 31 2023"Is there relief for renters and hope for more property buyers? Find out here." - Strategy Executive, Marco Zande

While renting is a vital part of Australia’s housing market, it has been failing many.

Nationally, advertised rents have soared 11% year-on-year, and vacancy rates are at historic lows. With the outlook remaining challenged, the budget's new housing line items honed in on this area.

Increased assistance payments for low-income renters, measures to boost rental supply and measures to increase construction of social and affordable rental housing are the big-ticket items.

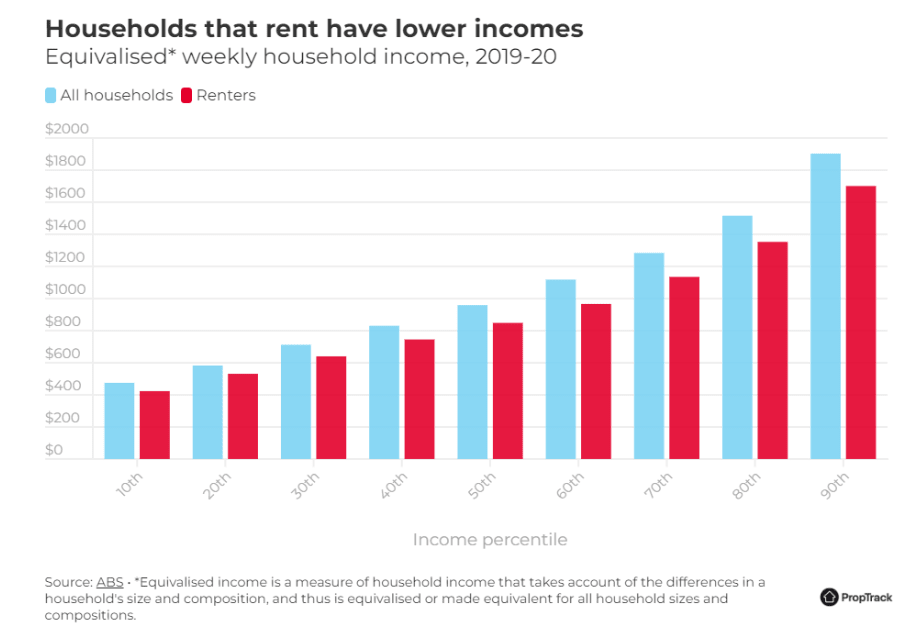

Given the one in three households that rent are more likely to be younger Australians, on lower incomes, with less wealth than owner-occupiers, and typically lower savings buffers, the measures will come as some relief.

Commonwealth Rent Assistance increases

Commonwealth Rent Assistance is already available to Australians on pensions and benefits including JobSeeker, the Family Tax Benefit and Parenting Payment.

The budget has delivered funding to increase the maximum rates of the Commonwealth Rent Assistance payment by 15% in a bid to help ease pressures on low-income renters.

The maximum increase will be between $15.73 and $31.76 a fortnight.

Renters currently receiving Commonwealth Rent Assistance will receive up to $31 extra a fortnight from September, a measure aimed at assisting vulnerable lower-income renters. For most low-income earners, rent assistance is a targeted and cost-effective safety net.

Strong demand to rent, bolstered by the fast pace of immigration, is well outstripping the supply of available rentals, with the total supply of rentals in the capital cities sitting at historic lows in March, with the supply of available rentals down 18.3% year-on-year.

Meanwhile advertised rents in the capital cities increased by 13% over the year to March with the extreme shortage of rental stock weighing.

This increase to Commonwealth Rent Assistance is the largest in more than 30 years, but rent assistance payments have long fallen behind soaring rental prices.

In the capital cities rental prices are up 18% on pre-pandemic levels, while in regional areas rents are up 23%.

Capital city rental markets are significantly undersupplied. As a result, prices are rising briskly and vacancy rates trending lower.

Pegging payments to adjust in line with subsequent market rental price increases in the future, or a regular review schedule to ensure that assistance payments keep pace with surging rents, could have been a welcome step further.

The persistent undersupply of properties available to rent is pushing vacancy rates lower. And with rental demand outstripping supply, weekly rents are increasing strongly. And without a meaningful increase in rental supply on the horizon rental prices will continue to grow in the coming months.

But rental price increases aren’t the only problem. These challenges don’t just manifest in budgetary constraints as weekly rents increase, but with fierce competition properties are renting out at record speeds and finding an available rental is tough. The level of competition for limited rentals is forcing many to make sacrifices.

In the long run, the best solution is to provide more dwellings, but this takes time.

To read the full article, visit realestate.com.au for more analysis.

Creagh, E. (2023, May 9). Federal budget 2023: What it means for the housing market. Search for Real Estate, Property & Homes - realestate.com.au. https://www.realestate.com.au/insights/federal-budget-2023-what-it-means-for-the-housing-market/