Brisbane house price growth to ‘accelerate’ 19pc in next 3yrs

September 11 2019Brisbane is on the cusp of a mini boom with house prices set to “accelerate” over the next three years — outperforming every other capital city, a leading industry player predicts.

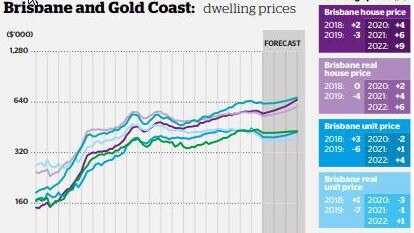

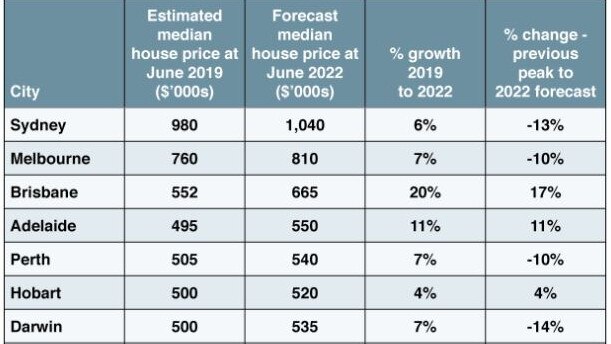

In its Australian Housing Outlook 2019-2022, released today, QBE forecasts median house price growth in the Queensland capital to average 6.4 per cent per annum over the next three years, boosted by tourism, an improving economy and affordability.

That’s more than a 19 per cent increase in average growth by 2022, taking the median house price to $660,000.

In its previous report a year ago, the insurer only predicted 11 per cent growth for Brisbane house prices by 2022, so the outlook has improved markedly.

QBE Lenders’ Mortgage Insurance CEO Phil White said there was an undersupply of freestanding houses in Brisbane, which was increasing demand for that type of product.

“There are a lot more units and very few freestanding houses being built and that change has been quite noticeable over the last few years,” Mr White said.

“The type of people that are moving to Brisbane are looking for lifestyle and they’re families. “They prefer housing, but we’re just not building the houses.

“We need to meet that demand. As a result, demand increases but supply is not increasing at the same rate. That will drive house prices up disproportionately high.”

The QBE report, based on new data provided by BIS Oxford Economics, states that tourism is boosting the economy in Queensland and a decade of modest house price growth has left the market “relatively affordable”.

“With the Queensland economy also forecast to strengthen, residential price growth is forecast to steadily accelerate through to 2021/22,” the report said.

But Mr White said there was a risk the data might be overstating projected growth in Brisbane.

“At the same time, while forecasts for the Brisbane house market point to solid growth, and the fundamentals do look very strong, there is a risk that consumer caution and oversupply of units could temper these projections,” he said.

The report said “the lower Australian dollar is boosting the local tourism and education sectors” in Brisbane, with a number of large building and infrastructure projects, such as Queens Wharf and Cross River Rail, underway.

“Brisbane continues to maintain a significant affordability advantage over other east coast capital cities, and as employment prospects improve, demand from home buyers who are priced out of these cities is expected to increase,” the report said.

AMP Capital head of investment strategy and chief economist Shane Oliver said Brisbane’s housing market was due for a “catch up after years of not going anywhere”.

“It’s fallen way behind Sydney and Melbourne,” Mr Oliver said.

“The reality is Brisbane has lagged, it is quite cheap compared to Sydney and Melbourne and it’s just a better value market.”

Mr Oliver said he believed Queensland’s economy was slowly starting to turn a corner.

“I do think it will start to improve in the year ahead,” he said.

“I suspect as population growth continues to improve and mining investment picks up again, it should help the state.”

Real Estate Institute of Queensland CEO Antonia Mercorella said Brisbane’s undersupply of new, freestanding houses would drive up prices.

“With demand for houses on the rise — particularly amongst families — and a growing population, it is likely that prices will significantly increase,” Ms Mercorella said.

She said Brisbane’s lifestyle and affordability were attracting interstate migrants, which were increasing the population, pushing down supply and, in turn, driving up prices.

“Increasingly we’re seeing residents from the southern states flocking to Brisbane with the knowledge that their dollar will go much further when it comes to purchasing property,” she said.

“Not only will they get much more for their money, they’ll enjoy the benefits of a fantastic climate, relaxed lifestyle and improved liveability.”

The outlook is not as rosy for the Brisbane unit market, according to QBE.

“Challenges will remain for the Brisbane unit market given the weakened lending environment for investors and the excess supply of units,” the report said.

QBE expects a decline of two per cent in the median unit price in 2019/20, but has forecast modest price growth in 2020/21 and 2021/22 as unit completions slump.

“Nonetheless, any recovery is likely to remain modest until investors return to the market in larger numbers, with Brisbane’s median unit price forecast to be up by a total of three per cent in the next three years to $435,000 by June 2022,” the report said.

Other parts of the state are looking at more steady growth over the next few years.

On the Gold Coast, QBE expects population growth and a steady supply of infrastructure projects to continue to underpin demand for property.

House price growth of 2.9 per cent a year to 2022 is expected, taking the median house price there to $680,000.

The Sunshine Coast is tipped to continue to benefit from internal migration, with house prices forecast to grow by seven per cent over the next three years.

It is expected the worst is now over for Townsville’s housing market with residential prices having troughed.

“The Townsville Stadium project will contribute to the economy, while the city may benefit from recent rises in commodity prices and consequent increases in exploration and investment,” the QBE report said.

The median house price is forecast to climb to $345,000 by June 2022, with a cumulative rise of 10 per cent over the three years.

Source: https://www.realestate.com.au/news/brisbane-house-price-growth-to-accelerate-19pc-in-next-3yrs/

Tilley, E. (2019, September 8). Brisbane house price growth to ‘accelerate’ 19pc in next 3yrs. Retrieved from https://www.realestate.com.au/news/brisbane-house-price-growth-to-accelerate-19pc-in-next-3yrs/