Australian property markets roar back to life after 22 months of falls

September 09 2019National home values grew by 0.8 per cent over August, suggesting the Australian property market may have turned a corner.

This is the first time the national index has increased since October 2017, the latest research from property analytics firm, CoreLogic has revealed. It came after a July which saw property values neither increase nor decrease.

And, research director Tim Lawless said, not only was this the turning point, but the percentage of growth was substantial.

“The significant lift in values over the month aligns with a consistent increase in auction clearance rates and a deeper pool of buyers at a time when the volume of stock advertised for sale remains low.

“It’s likely that buyer demand and confidence is responding to the positive effect of a stable federal government, as well as lower interest rates, tax cuts and a subtle easing in credit policy.”

The lift comes after a 12 month period which saw values decline 5.2 per cent, and an overall fall of 7.6 per cent since peak.

And, the increase in values also follows two consecutive interest rate cuts from the Reserve Bank of Australia in June and July.

How did each state perform?

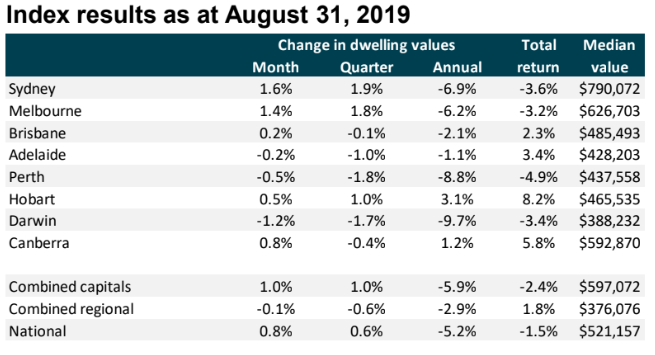

Housing values increased across Sydney (1.6 per cent), Melbourne (1.4 per cent), Brisbane (0.2 per cent), Hobart (0.5 per cent) and Canberra (0.8 per cent).

However, across Adelaide (-0.2 per cent), Perth (-0.5 per cent) and Darwin (-1.2 per cent), prices fell.

“While the ‘recovery trend’ is still early, it does appear that growth trends are gathering some pace, particularly in the largest capital cities,” Lawless said.

Sydney prices are still 13.3 per cent less than they were at their peak, while homes in Darwin are valued 30.7 per cent less than they were at their peak.

In Perth, values are 20.6 per cent less than they were at their peak. And even Hobart is 0.3 per cent less valuable than it was at its peak - that’s despite regional Tasmania currently sitting at its peak.

Across the regions, only the Northern Territory, Tasmania and Victoria saw property values rise in August.

Expensive homes lead the charge

As the most expensive quarter of properties fell the most, they’ve also led the return to growth.

“The rapid recovery across higher valued properties makes sense considering this sector of the market recorded a more substantial correction,” Lawless said.

“Although values have fallen across the board over recent years, the larger declines amongst more expensive properties mean that they are relatively more affordable for those looking to upgrade,” he added.

Rents continue to fall

While dwelling values have changed direction, rents continue to fall, declining by 0.1 per cent in August. That’s the third month in a row of negative rent movements.

What does it all mean?

While CoreLogic had previously predicted a slow recovery, today it said that as home loan rates grow cheaper and housing credit restrictions soften, the recovery could occur as quickly as the market fell.

“No doubt, policy makers and regulators will be monitoring the housing market indicators very closely over the coming months.

“At the outset, it appears that a rapid recovery would confirm that low interest rates and a loosening in credit policy is reigniting some market exuberance, despite housing affordability remaining a significant challenge, rising unemployment, low wages growth and near record-high levels of household debt.”

Source: https://au.finance.yahoo.com/news/australian-property-market-surges-back-to-growth-002405772.html

Dean, L. (2019, September 2). Australian property markets roar back to life after 22 months of falls. Retrieved from https://au.finance.yahoo.com/news/australian-property-market-surges-back-to-growth-002405772.html